Dry Falls Brewing On Track To Recover $38K In Costs With Dual Pricing

Learn how Arryved customers offset rising costs with Dual Pricing.

What could your business do with an extra $38k per year?

Just ask the Arryved customers capitalizing on Dual Pricing. As margins continue to shrink due to rising production and labor costs, creative cost optimization strategies are essential for small businesses.

Arryved’s Dual Pricing Program empowers businesses to recover payment processing fees in order to cut costs and maximize revenue.

Dual Pricing Adds $20K Per Year In Profit On Average

Arryved data shows customers with an average $50k in monthly sales volume saw a 3.2% profit increase in their first month with Dual Pricing. That’s just shy of $20k per year in additional profit.

If you’re not familiar with Dual Pricing, here’s how it completely recovers payment processing fees for both credit and debit card transactions:

- Menus list everything in card prices, including sales tax. These card prices are adjusted at your discretion, ultimately covering costs associated with card transactions.

- At payment, guests are given the option to pay with cash or card.

- If a guest pays with card, they pay the standard prices listed on the menu.

- If a guest pays with cash, Arryved automatically applies the discounted rate.

Note that this is not the same as surcharging. Surcharging is often applied to debit transactions (which violates Visa and Mastercard rules and federal regulations), it’s not legal in every state (which puts the merchant at risk of incurring $50,000 violation fees), and it results in a poor experience by surprising guests at checkout with an additional fee.

Dual Pricing, on the other hand, recovers payment processing fees from both debit and credit transactions, is legal in every state, and provides a better guest experience.

Guest Reactions To More Payment Options Are Positive

According to aggregate data from Arryved customers using Dual Pricing, guests’ credit card usage has remained the same, showing zero impact on consumer behavior.

As far as their reactions to menu price updates, Arryved customers report that guests hardly notice the change. When they do, a simple explanation from the server has been met with pleasantries and understanding.

“It was such a non-issue, it was kind of laughable,” Abigail Malcolm, Co-Owner and GM at Zambaldi Beer, says about their guests’ responses to Dual Pricing.

In an industry dedicated to delighting guests, it’s a relief knowing that Dual Pricing doesn’t compromise exceptional experiences.

“Dual Pricing is a really easy way to help with our overall cost increases without raising prices for our guests,” notes Jeff Golliher, Owner at Dry Falls Brewing. His brewery chose to pass card processing fees onto guests instead of raising all menu prices to offset increased costs.

“Look, we had a decision to make. Do we go up a dollar per pint? Or 30 cents per pint so you can use your credit card?” Jeff reasons.

Guests at Dry Falls and Zambaldi prefer the latter, as do brewery guests across the country, according to Arryved’s data.

Recovered Payment Processing Fees Offset Rising COGS

Food and beverage businesses are no strangers to the historic inflationary environment. Dry Falls Brewing reports that cost of goods sold (COGS) for beer has increased 30-40%!

While creative strategies such as revenue-boosting service tools help, Dual Pricing has been the single most effective tool in increasing profits for Arryved customers.

“We’re able to put more money back into the business and continue to expand and grow,” Jeff says, enthusiastic about the continued cost savings of Dual Pricing.

Abigail at Zambaldi shares his sentiment: “It’s comforting to know there’s more money coming in on every single transaction.”

It’s only getting more popular: An estimated 30,000 merchants implemented Dual Pricing in 2022, including behemoth businesses like Starbucks and Hilton.

So, what’ll it be? A redesigned bar? Higher production capacity? Dry Falls has their sights set on a snazzy new boiler.

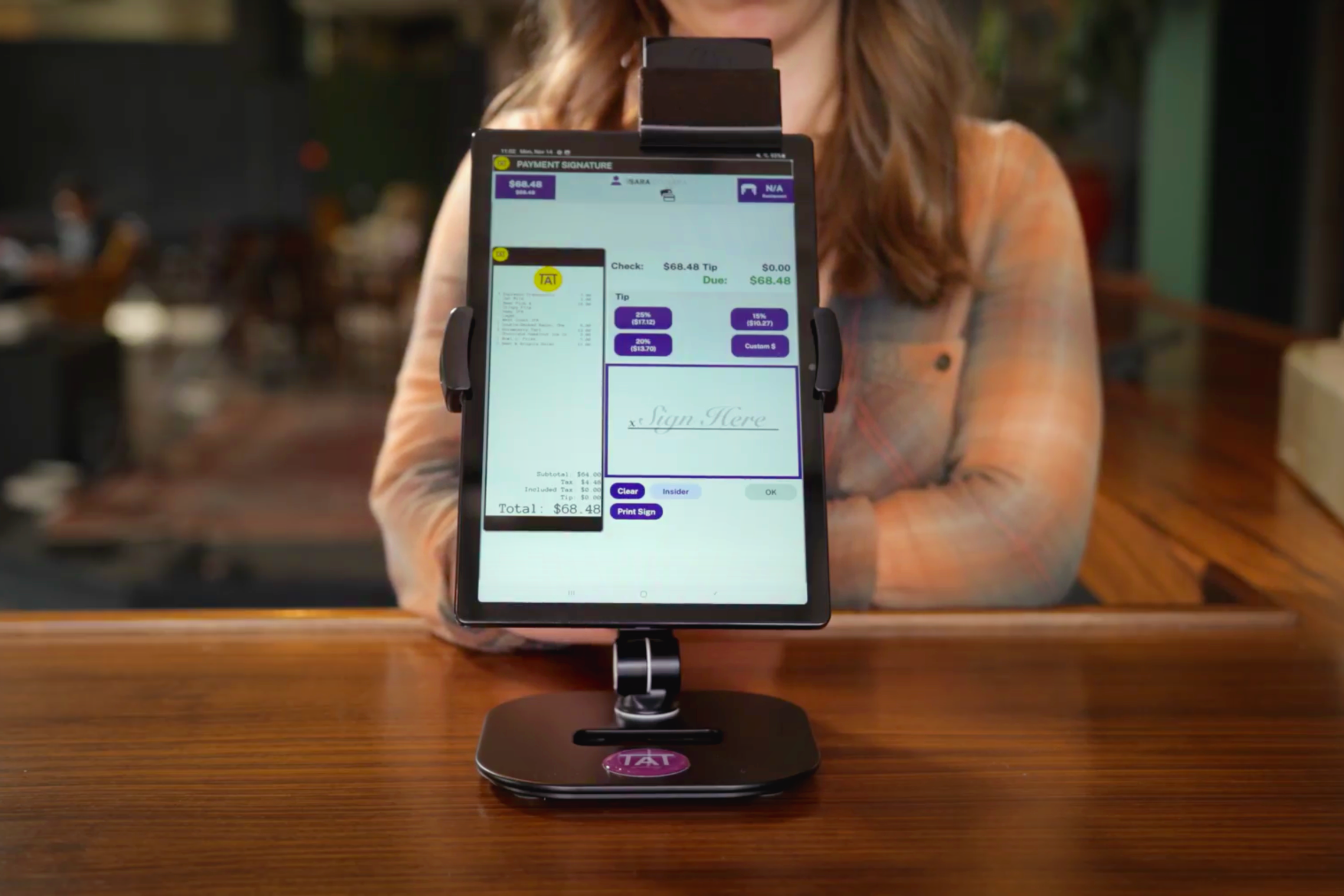

See Arryved and Dual Pricing in action, and boost your business profits by $20k per year!